But if the value of refundable tax credits exceeds total taxes owed, the excess can be paid out to the taxpayer. (This is distinct from the refunds eagerly awaited by legions of taxpayers, which typically result from more tax being withheld from people’s paychecks than they end up owing.)Ĭredits are used to offset taxes owed – not only income tax but certain other taxes, too, such as the self-employment tax or the penalty tax on early withdrawals from qualified retirement plans. Millions of Americans actually get money from the IRS, largely due to refundable tax credits. The average effective tax rate for those taxpayers was 1.5%, even before refundable tax credits were applied. (About 4,600 of those people ended up paying tax anyway, mainly due to the alternative minimum tax.) Another 60.3 million returns showed AGIs of less than $30,000. In 2020, the IRS received nearly 5.3 million individual tax returns that showed no AGI and hence no taxable income. The average effective tax rate for taxpayers with AGIs of $10 million or more was actually a bit lower (25.5%), mainly because they tend to get more of their income from dividends and long-term capital gains, which are taxed at lower rates than wages, salaries and other so-called “ordinary income.”Īt the other end of the income scale, tens of millions of Americans owed little or no federal income tax, especially after factoring in the effects of refundable tax credits, such as the child and earned-income credits. In 2020, the most recent year for which the IRS has detailed data, all groups of taxpayers with $1 million or more in adjusted gross income (AGI) had average effective tax rates of more than 25%.Īverage effective tax rates, defined here as total income tax as a percentage of AGI, were highest among taxpayers with AGIs between $2 million and $10 million (nearly 28%). But the system’s progressivity tends to break down at the very uppermost income levels. Taken as a whole, the federal income tax is progressive, meaning that those with higher incomes pay at higher rates. The IRS expects more than 168 million individual tax returns to be filed this year if previous years’ patterns continue, about two-thirds of those returns will show some taxable income. Along with the IRS data, we relied on the Office of Management and Budget for historical data on the share of federal receipts from various sources.Īll told, the federal government expects to collect about $2.33 trillion in individual income taxes this year, accounting for nearly half (48.5%) of its total receipts, according to the Office of Management and Budget. For much of our analysis, we combined the IRS’s AGI categories into eight larger groups, which made some underlying trends easier to see.

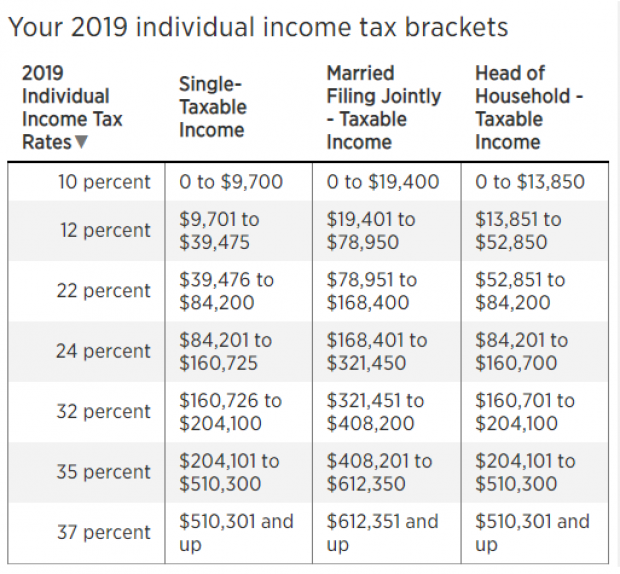

FEDERAL TAX BRACKET PERCENTAGES 2019 PLUS

In most cases the IRS breaks down its estimates into 18 groups by adjusted gross income, or AGI, plus a 19th group with no AGI. (The strata were defined not only by income, but also by such factors as the presence or absence of special forms or schedules.) IRS researchers then weighted the sample data for each stratum, or subpopulation, to reflect the total number of returns in it.

The IRS data we used was derived from a stratified probability sample of all individual income tax returns filed in a given year. Nor did we attempt to quantify the relative incidence of state and local taxes, such as sales tax and property tax.) We concentrated most of our research on the individual income tax – the federal government’s single largest revenue source, and what most people tend to associate with “paying my taxes.” (That said, for millions of middle- and lower-income Americans, the payroll taxes that fund Social Security and Medicare take a bigger bite out of their gross income than income taxes do.

It makes much of that data available through its Statistics of Income program. The IRS, by the nature of its mission, collects copious data on Americans’ financial lives. With the 2023 tax season nearing its end, Pew Research Center analyzed IRS data to shed light on a poorly understood topic. The American tax system manages to combine ubiquity, complexity and opacity.

0 kommentar(er)

0 kommentar(er)